HOKKAN HOLDINGS LIMITED (hereafter “we” or “the Company”) has set its policy on information disclosure and dialogue between the Company and shareholders/investors as follows, to promote constructive dialogue with shareholders/investors, contributing to sustainable growth of the Company and enhancement of mid-to long-term corporate value. We will implement appropriate information disclosure and IR activities according to the policy set out below.

1. Standards of information disclosure

We will disclose information on decided facts and occuring facts as well as financial results that may have material impact on investment decisions, pursuant to applicable laws and regulations including the Financial Instruments and Exchange Act and Rules on Timely Disclosure of Corporate Information (hereafter “Timely Disclosure Rules”) laid down by the stock exchanges where our stocks are listed (hereafter “listed exchanges”).

We will also appropriately disclose information deemed helpful for shareholders and investors to better understand the Company including non-financial information on environmental activities and social aspects, even if the information is not required to be disclosed by applicable laws and regulations or the Timely Disclosure Rules.

2. Method of information disclosure

In compliance with rules set out by listed exchanges, when information arises on determined facts and occurring facts as well as financial results that may have impact on investment decisions, we will appropriately disclose such information according to the methods specified by laws and regulations and the Timely Disclosure Rules and post the information on the Company website promptly after disclosure.

We also disclose information deemed helpful for shareholders and investors to better understand the Company, through such methods as distribution of news release and posting on the Company website.

3. Prevention of insider trading and fair information disclosure

We will promote fair information disclosure and prevent insider trading and thereby secure trust in the Company in the securities market, by setting standards on the management of material information that officers and employees of the Company and its subsidiaries learned during the course of their duties and standards of conduct related to sales and purchase of stock, etc. by officers and employees.

We pay careful attention to the management of material information including insider information when engaging in dialogue. We use materials that have been carefully checked in advance when we conduct IR activities including briefings for institutional and private investors and will not provide undisclosed material information as a general rule. However, should we unintendedly communicate material information, we will take necessary steps such as promptly disclose the information to the public. We also pay consideration so that information will be communicated as fairly as possible in accordance with the purport of fair disclosure, for instance by promptly posting briefing materials on the Company website when a briefing is held.

4. Business forecast and future prospect

Of all the information included in business forecasts, management plans, management strategies, management policies etc. that we disclose, information that is not historical facts represents forward looking statements prepared to reflect management’s decisions based on information available to the Company at the time and on certain assumptions that it deems reasonable. Actual results may differ significantly from those discussed in the forward-looking statements due to various risks and uncertainties.

5. Quiet period

We set, in principle, a period of four weeks up to the announcement of financial results for each quarter as the quiet period to prevent leakage of financial results information and ensure fairness of information disclosure. During this period, we do not conduct IR activities and will refrain from providing any answers or comments to inquiries related to financial results or outlook.

However, when revision of financial outlook or information that should otherwise be disclosed arises, we will disclose such information according to the rules set out by the listed exchanges even during the quiet period. We will also respond to inquiries related to information that has already been publicly disclosed.

6. Development of internal systems

[Internal system related to timely disclosure]

We will appropriately operate this policy and will develop and maintain internal systems for executing timely and appropriate information disclosure according to laws and regulations and the Timely Disclosure Rules.

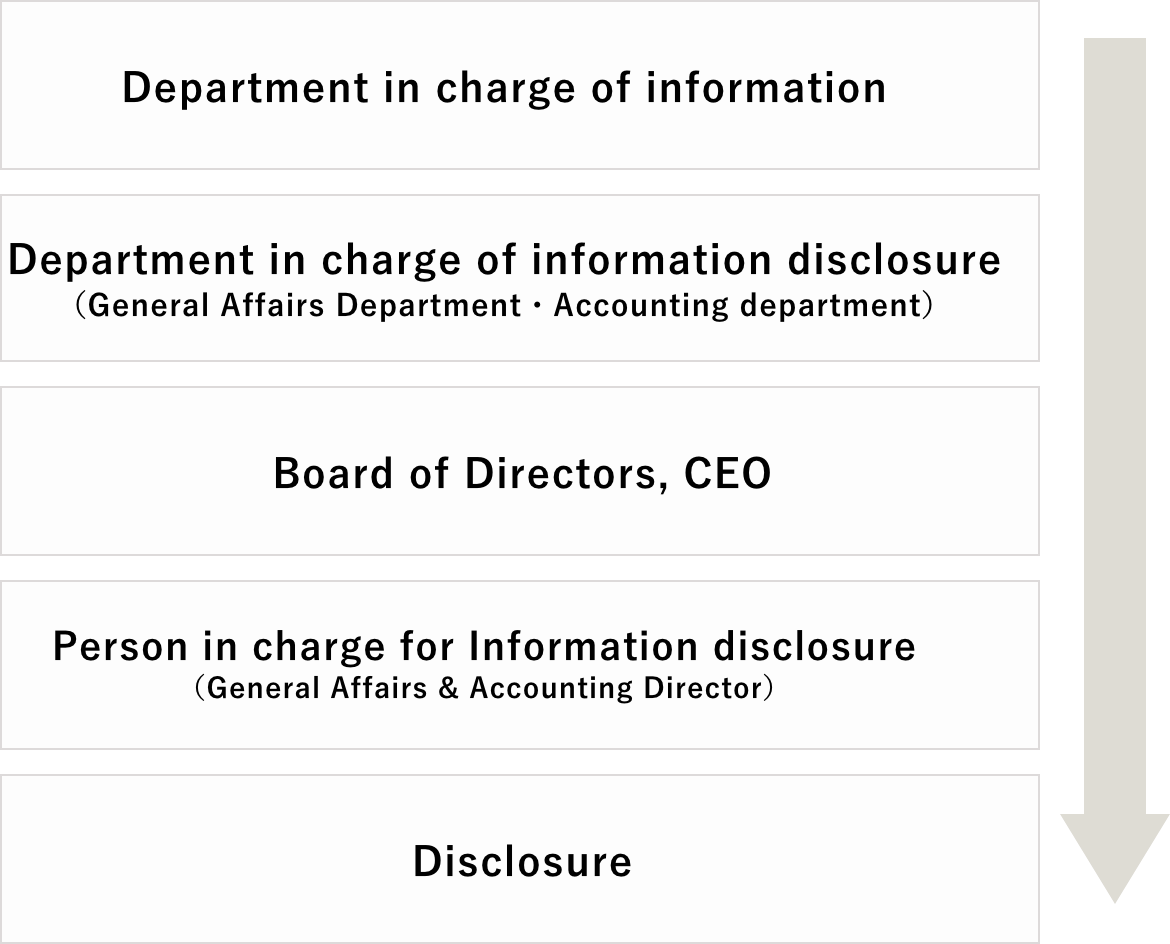

With regard to disclosure of company information, information on financial results and accounting operations is handled by the Accounting and Finance Department and other information by the General Affairs Department. Directors respectively in charge of the Accounting and Finance Department and General Affairs Department serve as the person responsible for the disclosure of respective information.

Within the Accounting and Finance Department and General Affairs Department, information prepared and reported by the sections in charge is checked against the Timely Disclosure Rules to identify if there are any determined facts or occurring facts that should be disclosed. When any of the information needs to be disclosed, it is submitted to the Board Meeting or the Representative Director and disclosed by the person responsible for the disclosure following resolution or decision of approval.

[Internal system related to IR activities]

With the active engagement and support by the Representative Director, IR activities are led by the Director in charge of the General Affairs Department serving as the person responsible for IR activities targeted at both private and institutional investors.

The General Affairs Department handles most of the preparation work for IR activities including the collection and compilation of necessary information from respective Group companies.

With regard to IR activities for institutional investors, top management examines the information to be disclosed for its accuracy and fairness prior to disclosure. Following IR activities held with institutional investors, we obtain an evaluation report from external IR support companies, which is submitted to top management and the Board of Directors along with opinions and concerns raised in the IR activities to ensure appropriate and effective feedback.